Investing isn't optional. WHY?

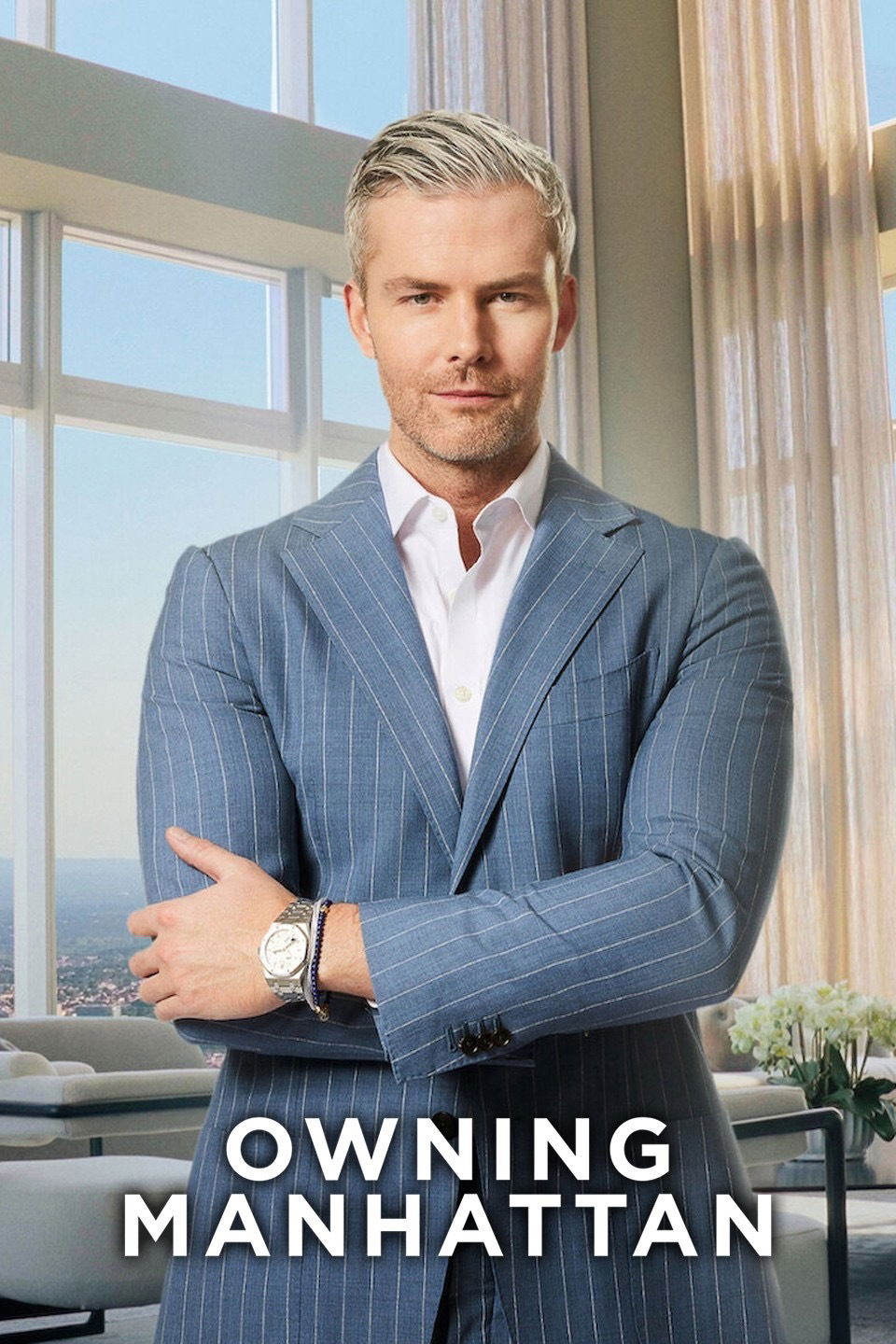

This is a reality show on Netflix about this handsome real estate mogul, Ryan Serhant leads one of the biggest firms in New York and pushes his agents to greatness while tackling the most expensive listings.

Watching his fast paced lifestyle and his pitching skills to his high net worth clients stressed me out. 🤯

But, there was one favourite line I picked up during his phone conversation to one of his agents. That is "𝙔𝙚𝙨𝙩𝙚𝙧𝙙𝙖𝙮 𝙞𝙨 𝙖𝙡𝙬𝙖𝙮𝙨 𝙚𝙭𝙥𝙚𝙣𝙨𝙞𝙫𝙚, 𝙩𝙤𝙢𝙤𝙧𝙧𝙤𝙬 𝙬𝙞𝙡𝙡 𝙗𝙚 𝙢𝙤𝙧𝙚 𝙚𝙭𝙥𝙚𝙣𝙨𝙞𝙫𝙚."

The real traps while doing investment: 🕰️ People wait.

"I'll start investing when I make more money" It feels logical. But, if you're saying this now, you'll probably still be saying it later even when you're making more.

It's an excuse loop that holds many people back. Delaying costs you MUCH more than you think.

If you're waiting for the "perfect time", you'll be waiting forever. Till prices become too expensive to even catch up.

The better move?

Make investing a habit. Set aside $$ or top ups every time you got paid. You'll automatically leverage on Dollar Cost Averaging = buying more when prices dipped.

Stay invested -- leveraging on the compounding effect over time. You can't compound what you never start.

Start even if is a small amount -- Investing $100, $200 might feel pointless when you're just getting started. But, compounding effect is a very STRONG phenomenon which converts your small consistent moves now to BIG RESULT later.

Question: When is the best time to start investing, building your retirement nest eggs?

Answer: Best time is right after you start working.

An article from Straits Times saying more Gen Zs and millennials are being over conservative in their investment approach despite the time runway they have.